Not known Facts About Life Insurance In Dallas Tx

Wiki Article

Not known Facts About Truck Insurance In Dallas Tx

Table of ContentsLife Insurance In Dallas Tx Fundamentals ExplainedHealth Insurance In Dallas Tx - The FactsThe Definitive Guide for Health Insurance In Dallas TxHome Insurance In Dallas Tx - The FactsSome Ideas on Health Insurance In Dallas Tx You Should KnowNot known Details About Home Insurance In Dallas Tx

And because this coverage lasts for your whole life, it can help sustain long-term dependents such as kids with disabilities. Con: Expense & complexity an entire life insurance coverage plan can be considerably much more expensive than a term life policy for the same survivor benefit quantity. The cash money value component makes whole life extra complicated than term life due to fees, tax obligations, passion, and various other specifications.

Bikers: They're optional attachments you can utilize to tailor your policy. Term life insurance plans are typically the best remedy for individuals who require budget-friendly life insurance for a certain duration in their life.

The Definitive Guide to Life Insurance In Dallas Tx

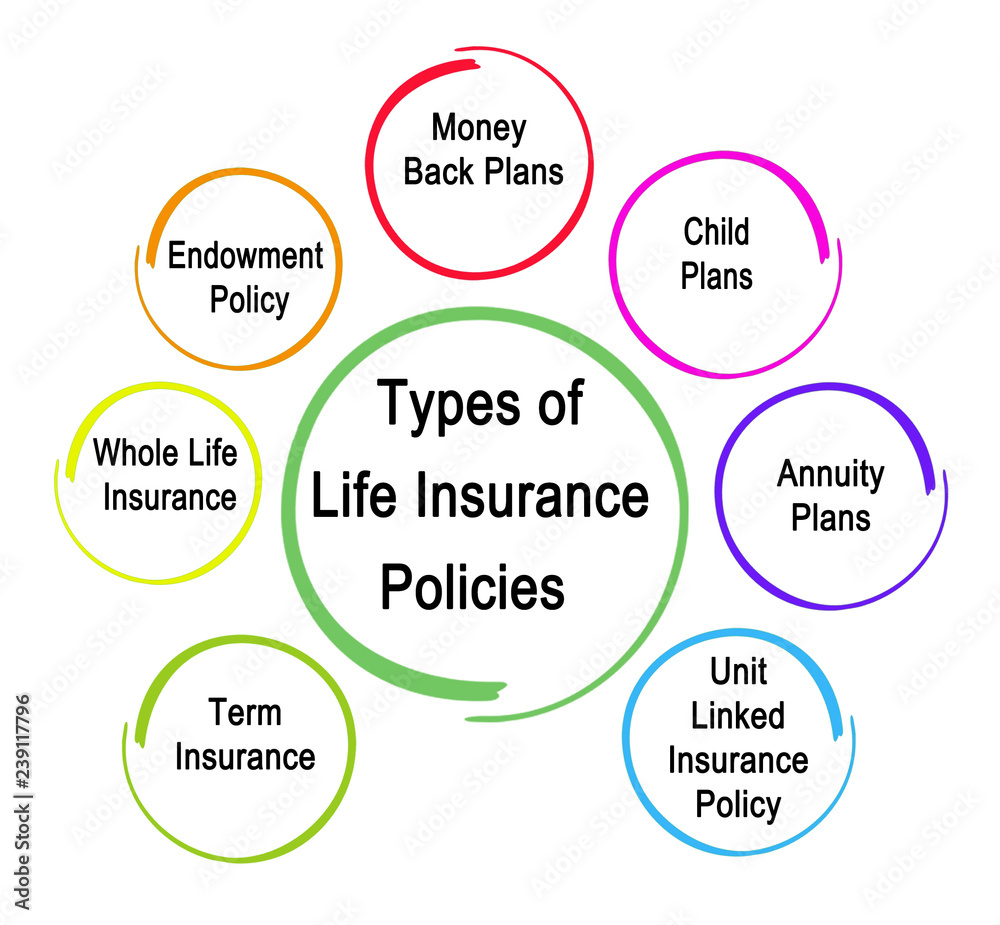

" It's constantly advised you talk with a qualified representative to identify the ideal service for you." Collapse table Currently that you recognize with the fundamentals, below are additional life insurance policy policy types. Numerous of these life insurance policy options are subtypes of those included over, meant to offer a particular purpose.Pro: Time-saving no-medical-exam life insurance policy offers faster accessibility to life insurance policy without needing to take the medical examination (Home insurance in Dallas TX). Con: Individuals who are of old age or have several wellness problems might not be eligible. Best for: Any person that has couple of health and wellness issues Supplemental life insurance policy, also called voluntary or volunteer supplemental life insurance policy, can be made use of to bridge the protection gap left by an employer-paid group policy.

Unlike other plan kinds, MPI only pays the survivor benefit to your home mortgage lender, making it a much a lot more limited choice than a standard life insurance policy plan. With an MPI policy, the recipient is the home loan firm or lender, as opposed to your household, as well as the survivor benefit reduces in time as you make mortgage settlements, similar to a lowering term life insurance plan.

Some Known Questions About Truck Insurance In Dallas Tx.

Since AD&D just pays out under details scenarios, it's not an ideal alternative for life insurance. AD&D insurance policy just pays if you're hurt or eliminated in a mishap, whereas life insurance policy pays for a lot of causes of fatality. Due to go to website this, AD&D isn't suitable for everybody, yet it might be helpful if you have a high-risk profession.

The 9-Second Trick For Health Insurance In Dallas Tx

Best for: Pairs who do not receive two specific life insurance coverage plans, There More Info are two major sorts of joint life insurance policy plans: First-to-die: The plan pays out after the very first of both spouses dies. First-to-die is the most comparable to an individual life insurance plan. It aids the surviving policyholder cover costs after the loss of financial support.What are the two major types of life insurance? Term and long-term are the two primary kinds of life insurance.

Both its period as well as cash money value make irreversible life insurance numerous times a lot more expensive than index term. Term life insurance coverage is usually the most budget-friendly and extensive type of life insurance because it's basic as well as gives monetary protection throughout your income-earning years.

The 6-Second Trick For Health Insurance In Dallas Tx

Entire, global, indexed global, variable, and funeral insurance are all sorts of permanent life insurance coverage. Irreversible life insurance policy typically features a cash value and also has greater costs. What is one of the most common sort of life insurance coverage? Term life and whole life are one of the most preferred kinds of life insurance policy.life insurance policy market in 2022, according to LIMRA, the life insurance policy research study organization. At the same time, term life premiums stood for 19% of the marketplace share in the exact same period (bearing in mind that term life costs are much cheaper than entire life costs).

There are four standard parts to an insurance agreement: Statement Web page, Insuring Arrangement, Exemptions, Conditions, It is very important to comprehend that multi-peril policies might have particular exclusions and problems for each and every type of coverage, such as collision coverage, clinical repayment insurance coverage, responsibility coverage, and more. You will require to see to it that you read the language for the details coverage that relates to your loss.

5 Simple Techniques For Commercial Insurance In Dallas Tx

g. $25,000, $50,000, etc). This is a recap of the significant pledges of the insurance provider as well as mentions what is covered. In the Insuring Arrangement, the insurance firm concurs to do certain things such as paying losses for covered perils, providing certain solutions, or concurring to protect the guaranteed in a responsibility lawsuit.Instances of excluded building under a home owners policy are individual residential property such as an auto, a pet, or a plane. Conditions are arrangements inserted in the policy that certify or put limitations on the insurer's guarantee to pay or execute. If the policy conditions are not met, the insurance firm can refute the case.

Report this wiki page